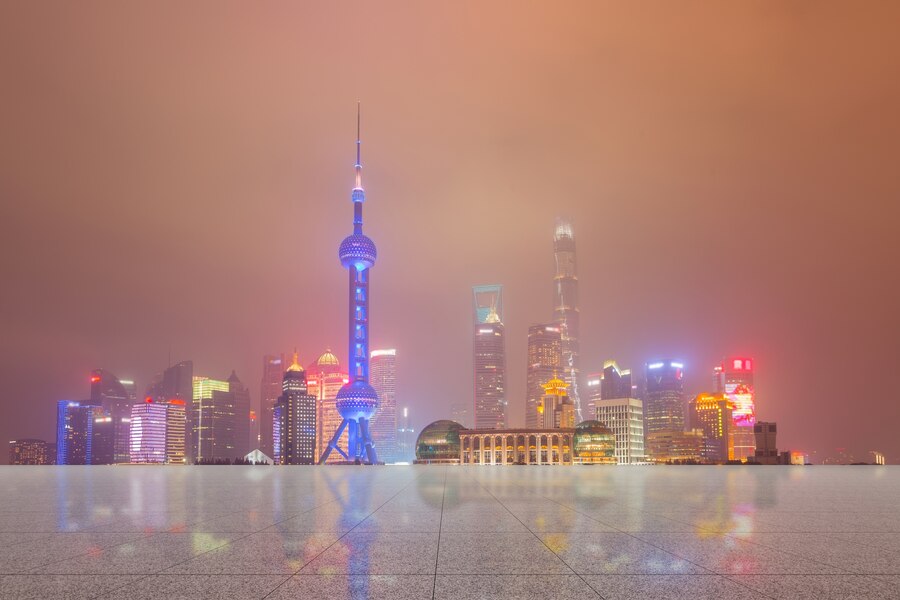

The Dubai International Financial Centre (DIFC) is one of the most influential financial hubs in the world. Strategically located in the heart of Dubai, DIFC has grown to become a prime destination for international businesses, particularly in the legal, accounting, and consulting sectors. With its world-class infrastructure, robust regulatory framework, and unique offerings tailored to global financial services, DIFC has established itself as a key player in the international business ecosystem.

1. World-Class Infrastructure and Facilities

DIFC is home to a state-of-the-art infrastructure designed to meet the needs of international businesses. The centre spans over 110 hectares and boasts modern office spaces, premium real estate, and cutting-edge technology, making it an attractive destination for legal, accounting, and consulting firms.

Key Features:

- Premium Office Space: DIFC offers high-quality office buildings that cater to the needs of large multinational firms. The commercial real estate within DIFC includes both office and retail spaces with flexible leasing options.

- Advanced Technology Infrastructure: DIFC’s technological infrastructure supports seamless communication and business operations. With high-speed internet, data centers, and secure IT systems, DIFC ensures firms can rely on robust systems to support their operations.

- Prime Location: DIFC’s central location in Dubai is another key factor. It is easily accessible to global clients, and its proximity to airports, hotels, and business hubs offers convenience to companies operating there.

This world-class infrastructure makes DIFC an ideal location for businesses in the legal, accounting, and consulting industries, providing the perfect environment to foster growth and innovation.

2. A Robust and Transparent Legal and Regulatory Framework

DIFC operates under its own independent legal system, based on the common law framework, which is a significant draw for international legal, accounting, and consulting firms. The legal system in DIFC is modeled after the UK’s common law, making it familiar and appealing to firms from jurisdictions that follow similar legal traditions.

Key Aspects of DIFC’s Legal and Regulatory Environment:

- DIFC Courts: The DIFC Courts offer a comprehensive and efficient judicial system for resolving disputes. The courts follow international standards and provide an arbitration-friendly environment, which is critical for legal and consulting firms operating in DIFC.

- Independent Regulatory Framework: DIFC has its own regulator, the Dubai Financial Services Authority (DFSA), which oversees financial services and ensures that businesses adhere to the highest standards of corporate governance and compliance. This autonomy allows firms to operate with confidence, knowing they are subject to clear and consistent regulations.

- Tax Benefits: DIFC offers a favorable tax regime with no taxes on income for 50 years, making it an attractive location for international accounting firms. This incentive allows firms to grow their business without being burdened by high tax rates, enhancing the financial attractiveness of establishing a presence in DIFC.

These legal and regulatory structures not only ensure transparency and fairness but also create a conducive environment for the growth of businesses, particularly for law, accounting, and consulting firms.

3. Access to a Global Network of Clients

DIFC serves as a business gateway to the Middle East, North Africa, and South Asia (MENASA) region, providing international firms with access to a growing and dynamic market. The region is home to a large number of high-net-worth individuals, major corporations, and governments looking for world-class legal, accounting, and consulting services.

How DIFC Opens Doors to New Opportunities:

- Strategic Positioning: Being located in Dubai, a global business hub, DIFC offers firms access to a thriving business ecosystem that spans multiple industries. With its connectivity to major global markets, companies based in DIFC can easily engage with clients across the Middle East and the rest of the world.

- Networking and Events: DIFC hosts a variety of networking events, conferences, and seminars where international firms can connect with potential clients, partners, and other professionals in the industry. This creates numerous business development opportunities for legal, accounting, and consulting firms.

- Collaborative Environment: DIFC fosters a collaborative atmosphere, with many firms working together on complex projects. The presence of global institutions in various sectors ensures that firms can collaborate and network with other high-profile businesses, enhancing their chances of securing new clients.

Access to this vast network of potential clients is one of the primary reasons legal, accounting, and consulting firms are drawn to DIFC. It allows them to tap into new markets, establish long-term relationships, and drive business growth.

4. Attractive Tax Regime and Financial Incentives

One of the most attractive aspects of DIFC is its favorable tax regime. The financial incentives offered to businesses operating in the center make it an appealing destination for international firms.

Tax Benefits for Firms in DIFC:

- Zero Tax on Income: DIFC offers a 50-year guarantee of zero income tax, which is a major attraction for firms seeking to optimize their tax obligations. This benefit applies to both businesses and employees, making DIFC a competitive destination for talent.

- No Withholding Tax on Dividends: There is no withholding tax on dividends or capital gains, further enhancing the tax advantages for firms operating in the region.

- Tax-Free Zones: As a financial free zone, DIFC provides a favorable business environment where firms can retain control over their assets and enjoy tax exemptions on profits and capital gains.

These tax incentives make DIFC highly attractive to international firms, allowing them to maximize their profitability while maintaining compliance with global tax regulations.

5. Focus on Innovation and Technology

DIFC has positioned itself as a hub for innovation, particularly in the fields of financial technology (FinTech), blockchain, and artificial intelligence (AI). For consulting and accounting firms, this focus on innovation presents unique opportunities to engage with cutting-edge developments in the financial services industry.

Opportunities for Innovation:

- FinTech and Regulatory Sandboxes: DIFC’s support for FinTech startups provides a unique opportunity for legal, accounting, and consulting firms to collaborate with tech-driven companies in the financial space. DIFC’s regulatory sandbox allows firms to test new financial technologies in a controlled environment, enabling businesses to innovate while adhering to legal and regulatory standards.

- Support for Startups and Entrepreneurs: DIFC’s commitment to fostering innovation is evident through its support for startups and entrepreneurs. The Centre’s infrastructure and programs cater to firms involved in emerging sectors like cryptocurrency, blockchain, and AI, providing firms with the tools to stay ahead in a rapidly changing industry.

This focus on innovation ensures that legal, accounting, and consulting firms in DIFC can remain at the forefront of technological advancements and adapt to the evolving needs of the business world.

6. Talent Pool and Skilled Workforce

DIFC is home to a diverse and highly skilled workforce. The Centre attracts professionals from around the world, making it an ideal location for global firms looking to tap into top talent.

Key Factors for Talent Attraction:

- Global Talent Pool: DIFC attracts professionals with expertise in finance, law, accounting, and consulting from across the globe. This enables firms to hire the best talent and build teams that can cater to a variety of client needs.

- Education and Training: DIFC partners with educational institutions to offer training programs and certifications. This ensures a continuous supply of well-trained professionals with the skills needed to excel in the industry.

Having access to this skilled workforce is an essential factor for the success of international legal, accounting, and consulting firms operating in DIFC.

Wrap Up

Corpin Consultants has established itself as one of the leading business setup companies in the UAE, offering invaluable support to international legal, accounting, and consulting firms seeking to establish a presence in the Middle East. With its world-class infrastructure, favorable tax environment, access to global markets, and a regulatory framework that encourages business growth, DIFC (Dubai International Financial Centre) has become a highly attractive destination for firms looking to expand in the Middle East, North Africa, and South Asia region.

By partnering with Corpin Consultants, firms gain access to expert guidance on navigating the DIFC’s offerings, which provide the ideal foundation for global businesses to flourish. As a key business hub, DIFC provides unmatched strategic location, innovative surroundings, and significant incentives that support the growth and success of its tenants.

For legal, accounting, and consulting firms aiming to set up or expand in the region, DIFC represents a unique opportunity to tap into the economic potential of the UAE, with Corpin Consultants by your side to ensure a smooth and efficient establishment process. The continued growth of DIFC, alongside Corpin Consultants’ expertise, guarantees that firms will remain well-positioned to thrive in the global business landscape for years to come.